When you have an accident or your car breaks down, the last thing you want to deal with is complicated insurance claim processes that consume all of your time. These processes can be stressful and frustrating, but with a bit of organisation and preparation, you can make the claim process easier.

“Taking out a mechanical breakdown insurance policy is a great way to assist a vehicle owner financially in the case of a mechanical failure on their motor vehicle. The secret to a smooth and stress-free claim process lies in understanding the process and using the right repairer,” says the chief executive officer of the Retail Motor Industry Organisation (RMI), Jakkie Olivier.

How the insurance claim process works

In general, insurance companies need the claim to be logged and validated before any repair work can begin on the damaged vehicle. “In order to validate a claim, the nature and extent of the damage need to be assessed. All claims must be logged as soon as possible and all failure reports, quotes and service records need to be submitted,” says the chief operations officer at MotoVantage, Anton Botha.

“The terms and conditions of a warranty normally require that approval of the claim be obtained prior to commencing with the repairs. With the exception of emergency repairs, a claim may be invalid if repairs are done without the necessary claims authorisation,” he explains.

Motorists need to make sure that they send their vehicles to authorised panel beaters with the right equipment for the job. Ideally, the panel beaters or mechanics should be approved by the insurance company to prevent any further delays in the repair process. If the insurance company does not approve of a mechanic, they can withhold payment until a new repair centre is chosen.

Tips to make the claim process less stressful

Here are some steps that vehicle owners should follow in order to make the insurance claim process easier and faster:

- Log the claim as quickly as possible after an accident or breakdown.

- Have your policy number and vehicle details on-hand when logging a claim.

- Most insurance companies will also ask for a vehicle service history, so keep this booklet in your car.

- Take your vehicle to an approved service station or panel beater that is recognised by your insurance company.

- Make sure that the service station or panel beaters provide your insurance company with a full report on the condition of the vehicle, diagnostic reports and photographs of the damage.

- Make sure that the repair centre provides a detailed quotation with accurate pricing of new parts. This will make it easier for the insurance company to approve the repair.

It is also important for vehicle owners to understand the insurance policy that they purchased and its specific provisions. Phone your insurance company when you need to make a claim and get them to walk you through the process and explain what will be covered in the repair costs.

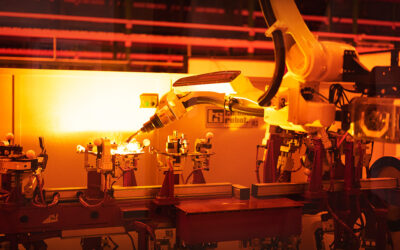

Formex Industries is a metal forming and assembly company that supplies a variety of complex products to the local automotive industry and export market. The company is based in the Nelson Mandela Bay metropole, South Africa’s foremost region for automotive manufacturing and export.

Formex specialises in producing components for the catalytic converter industry, as well as metal components and assemblies for the various vehicles. Formex aims to become one of the foremost suppliers for the South African automotive industry by 2035, aligning itself with the South African Automotive Masterplan (SAAM) which takes effect in 2020.

Formex is a Level 2 B-BBEE supplier with over 80% black ownership, of which more than 40% are black women. The company is owned by Deneb Investments Limited – a subsidiary of Hosken Consolidated Investments Limited (HCI) – one of South Africa’s biggest true B-BBEE companies listed on the Johannesburg Stock Exchange (JSE).

Follow us on Facebook, Instagram, LinkedIn and Google+ for the latest industry news and features relating to our products and services.